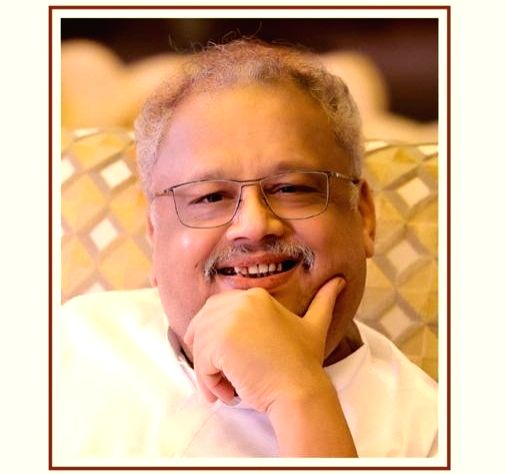

The stock market is abuzz with news of a strategic entry made by one of Rakesh Jhunjhunwala close associates. Known for their sharp investment moves and unparalleled understanding of market dynamics, the associate has recently taken a position in a stock priced under Rs 120. This move resulted in a staggering gain of Rs 1.09 crore in a single trading day, leaving investors speculating whether this could be the next Titan—a stock that turned into a multibagger under Jhunjhunwala’s vision.

Let’s dive into the details of this investment, analyze the stock’s potential, and explore whether it could mirror the success of Titan.

The Stock in Focus

The stock in question is a mid-cap company from the manufacturing sector, currently trading at an affordable price of under Rs 120 per share. Its robust fundamentals and growth potential have caught the eye of Jhunjhunwala’s associate, known for their meticulous approach to identifying undervalued gems in the market.

Why This Stock Stands Out

- Affordable Valuation: With a price under Rs 120, the stock offers an entry point for investors seeking value in the mid-cap segment.

- Recent Performance: The company posted impressive quarterly earnings, signaling strong operational efficiency and profitability.

- Industry Prospects: Operating in a high-demand sector, the company is well-positioned to capitalize on future growth opportunities.

The associate’s confidence in this stock has generated significant interest among retail and institutional investors.

Rs 1.09 Crore Gain in a Day

The stock saw a sharp rally on the day of the associate’s entry, gaining substantial traction in the market. The upward movement resulted in a gain of Rs 1.09 crore, underlining the potential impact of strategic investments by market veterans.

What Drove the Rally

- Institutional Buying: The associate’s entry prompted increased buying interest from other institutional investors, pushing up the stock price.

- Strong Fundamentals: The company’s financials, including revenue growth and profit margins, have reinforced its attractiveness.

- Positive Market Sentiment: A bullish outlook on the sector contributed to the stock’s rapid appreciation.

Is This the Next Titan?

Rakesh Jhunjhunwala investment in Titan transformed it into one of India’s most iconic multibaggers. Naturally, any move by his close associate prompts comparisons to this legendary success story.

Parallels to Titan

- Undervalued Entry: Like Titan in its early days, this stock is trading at an affordable valuation with significant upside potential.

- Strong Market Position: The company operates in a growing sector with minimal competition, much like Titan’s dominance in the jewelry segment.

- Experienced Backing: The associate’s involvement brings credibility and expertise, reminiscent of Jhunjhunwala’s influence on Titan’s trajectory.

While the parallels are intriguing, it’s essential to remember that market conditions and company fundamentals ultimately dictate success.

Key Considerations for Investors

1. Analyze Fundamentals

Before jumping on the bandwagon, investors should thoroughly evaluate the stock’s financial health, including revenue trends, debt levels, and profitability metrics.

2. Assess Growth Potential

Examine the company’s expansion plans, market share, and competitive advantages to gauge its long-term growth potential.

3. Diversify Investments

While this stock may seem promising, diversification is key to managing risk. Avoid overexposure to a single stock or sector.

4. Monitor Market Trends

Stay updated on market developments and news related to the stock. Changes in industry dynamics or economic conditions could impact its performance.

Conclusion

The fresh entry by Rakesh Jhunjhunwala close associate in a stock under Rs 120 has created ripples in the stock market. With a one-day gain of Rs 1.09 crore, this investment highlights the importance of identifying undervalued opportunities with strong growth potential.

While the stock shows promise and draws parallels to Titan’s legendary success, investors should approach it with careful analysis and a long-term perspective. For those seeking to make informed decisions, this could be the right time to explore this stock further.

List of Top Investors in India :- Top Investors

Leave a Reply